Gold and silver prices fell on Tuesday, extending recent volatility in the precious-metals market as subdued global participation and shifting investor expectations weighed on sentiment.

The decline comes after a strong rally earlier in the year, with traders increasingly booking profits and reacting to quieter trading conditions across major financial centres.

Precious metals continued to reflect the weaker tone in domestic trading, with data from the Multi Commodity Exchange of India showing gold commodity contracts trading at ₹151,700 per ten grams, while one-kilogram silver futures were quoted at ₹232,655.

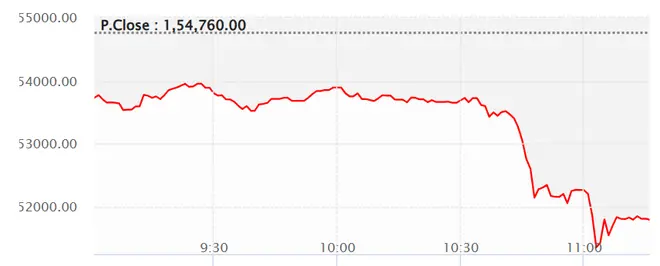

Gold futures intraday

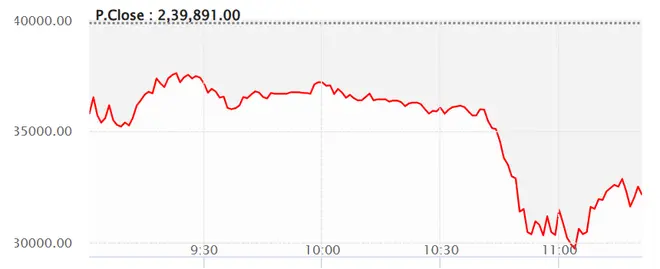

Silver futures intraday

Factors

One of the immediate factors behind the drop has been reduced market activity. Gold and silver prices declined as major markets remained closed, limiting liquidity and dampening price support.

Chinese markets were shut from February 15 to February 23 for Lunar New Year celebrations, while United States markets were closed for the Presidents’ Day holiday.

With two of the world’s most influential trading hubs inactive, global participation dropped noticeably, resulting in thinner volumes and downward pressure on bullion prices.

Beyond short-term trading conditions, broader macroeconomic considerations continue to shape the outlook for precious metals. Investors remain focused on interest-rate policy, inflation trends and signals about global economic growth.

These factors influence the attractiveness of bullion because gold and silver do not generate income. When borrowing costs are high and yields on other assets are attractive, demand for non-yielding assets tends to weaken.

Conversely, expectations about monetary easing could alter the trajectory. Precious metals typically perform better when interest rates decline, as the opportunity cost of holding them falls.

If theUS Federal Reserve moves ahead with rate cuts in the coming months, analysts believe gold and silver prices could regain momentum, supported by renewed investment demand and safe-haven positioning.

Will the fall continue?

Whether the fall will continue remains uncertain, as the recent decline appears driven largely by temporary factors such as thin global trading and profit-taking rather than a clear structural shift. Market direction will likely depend on inflation trends, economic growth signals and especially the policy stance of the Fed Reserve.

Precious metals typically face pressure when interest rates stay high because they offer no yield, but if borrowing costs are reduced in the coming months, investment demand could revive and prices may stabilise or rebound.

In the near term, volatility may persist, yet the longer-term outlook hinges on monetary policy and global economic conditions rather than short-lived market closures alone.

While prices have softened in the short term, market watchers continue to view bullion through a longer-term lens shaped by monetary decisions, inflation risks and the pace of global economic recovery.

Published on February 17, 2026